If 2020 were a football game the second quarter would have just kicked off.

We can all agree the first quarter was extremely tough. In early January, very few predicted COVID-19 would grow exponentially from Wuhan to become a global pandemic, triggering unprecedented isolation and lockdown measures worldwide. The social and human cost is already enormous, and this crisis will lead to lasting changes in the way we live, work and interact with each other throughout our communities.

Financial markets have reflected the unique scale and nature of the crisis. The VIX Index, a measure of forward-looking volatility (often referred to as Wall Street’s fear gauge), hit an all-time-record high of over 82 on 16 March. To put that into perspective, the fear gauge was range-bound within 10–25 for all of 2019. It currently remains elevated above 40 — an indication that investors still have heightened fears for the future.

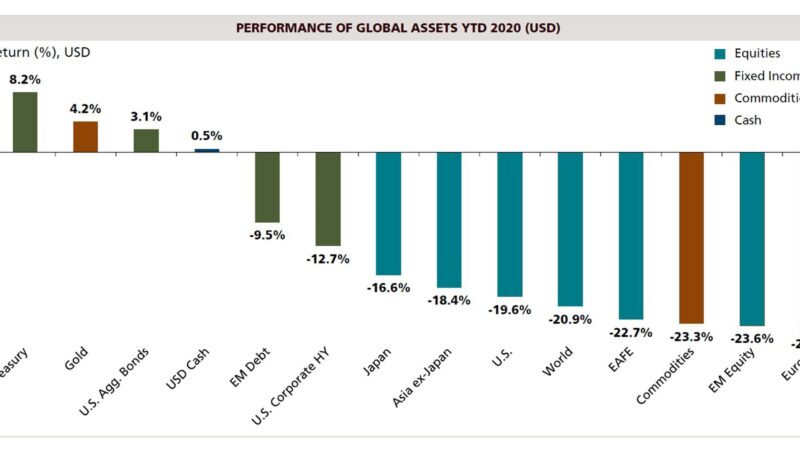

Those fears are reflected in the performance of virtually every major asset class, as we’ll discuss later in this piece. As well as testing how real assets compare, the power of diversification, and the important role that impact investment has in these uncertain times.

Performance of Major Asset Classes

Markets price in risk in advance, or at least seek to do so.

The extreme sell-off we’ve seen in the first quarter of this year (or football game, to continue the analogy) reflects the huge risks represented by the pandemic. While this has been somewhat offset by the coordinated monetary and fiscal response, it has led to enormous value destruction across most major asset classes for investors.

As seen in the following chart, virtually every liquid asset class is substantially below its 31-Dec-19 levels. Specifically global equities and commodities (ex-gold) have suffered large losses.

The only asset classes that have performed well on an absolute and relative basis are US treasuries and bonds, and gold, as investors flock to these ‘safe haven’ assets in periods of high volatility. Or when the fear gauge spikes, as we covered earlier.

While real assets or alternatives, and impact investments, are not shown in the relative performance chart, they exhibit low or no correlation to many of these underperforming asset classes.

Asset Allocation and Correlation

The fundamental premise of Conscious Investment Management (CIM) is that financial returns can be achieved at the same time as creating fundamental social and environmental value. Our investments create real impact, and our thesis is that they will prove more defensive and uncorrelated as a result. How we invest is deliberately designed to focus on lower risk, cash-yielding assets, typically with high levels of stable government backing.

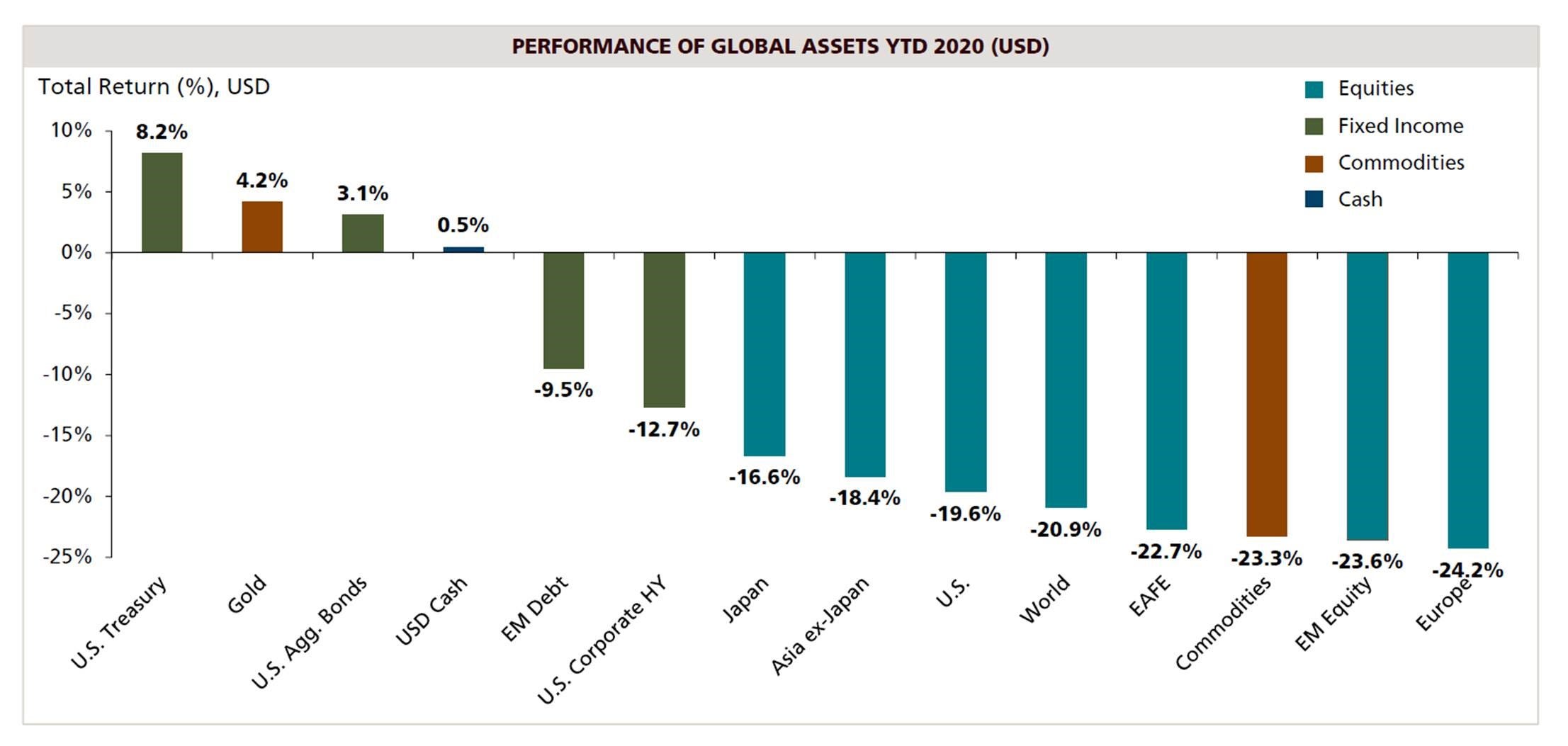

With that in mind alongside recent market movements, the need for effective and thoughtful asset allocation becomes clear.

The chart below shows long-term annual returns for Australian bonds and equities. Each time equity performance is negative, an allocation to bonds would have been positive for investors. Bonds are powerful in these examples because they moved in an uncorrelated way to equities. We expect that all CIM investments, and impact investing more generally, should act in the same way. Many of you are familiar with the investments in our portfolio, ranging from social impact bonds to specialist disability accommodation and community rooftop solar. The factors driving these investments are predominately unrelated to the broader equity markets and many other asset classes.

If COVID-19 continues for a long time, triggering a global economic recession and longer-term credit crisis, we would expect investors to seek a return ‘of’ capital, rather than return ‘on’ capital. In this environment, our investments, with income streams from government, would be one of the few asset classes that can provide investor certainty and will therefore likely outperform.

The Role of Impact Investing

We have witnessed the fragility and complexity of our interconnected society in recent months. Bare supermarket shelves, the collapse of many services, events and tourism industries, and the lack of appropriate medical facilities in many countries to deal with the pandemic.

The last few weeks have served as a reminder that financial investors can’t live in a bubble or behind a Bloomberg screen. Wealth itself means nothing without access to a stable society and the basics of life. Investing has real social consequences, and an investment into a CIM fund is a recognition of this.

We know many of our investors have been impacted by falling equity markets, but equally know that as impact investors, you value a long-term approach. Impact investments — such as ours in environmental and social infrastructure — will continue to generate value for years to come. They’re designed not just for one quarter of a football match, nor just one game, but for a whole season.

We hope that the social and environmental benefits of investments made by Conscious Investment Management encourage investors to take a step back from broader markets, and focus on the value in their long term portfolios.