Impact investing is now having its moment – so it’s important to understand how it works and how it differs from ESG investing, explains Matthew Tominc, Conscious Investment Management’s Chief Investment Officer.

Over the past two years, the domestic market for impact investing has tripled from A$5.7 billion to a staggering A$19.9 billion[1] as investors increase their focus on the sector, and investment managers respond by developing new strategies. Once a niche market, the term ’impact investing’ is now receiving significant attention from a variety of investors – from those who want to do good, to those who see the opportunity for uncorrelated returns. With all this growing attention and demand, however, we must be mindful that investment offerings are making a real positive impact, and not just applying a label. Key to this is understanding a manager’s definition of impact investing, and how it differs from ESG and sustainable investing.

Defining Impact

There are countless definitions of ‘impact investing’, and the label continues to be applied to many different investment activities. At Conscious Investment Management, we define it as an investment that is made to generate positive and measurable social and environmental outcomes, alongside a market standard financial risk adjusted return. A couple of points here deserve clarification:

Investments are made to generate positive outcomes. We believe impact investment should add positive social and environmental impact to the world. Society and the environment should be a better place as a result of an investment capital flow. The need for this benefit is heightened at a time when Covid-19 has affected the world and society has seen widening inequalities.

Investments should have a market standard financial risk and return. It’s critical that impact investors, pursuing their social and environmental goals, don’t compromise returns (or accept higher risks than they otherwise would for the same expected returns). As impact investors, if we were to compromise on our risk-adjusted returns, we’d begin to blur the line between our work and philanthropy. There are already fantastic philanthropists and charitable organisations in the world, and we don’t exist to substitute funds flowing to them. Conscious Investment Management requires market returns, providing a substitute for investment portfolios, not philanthropic capital.

Impact and the spectrum of responsible investing

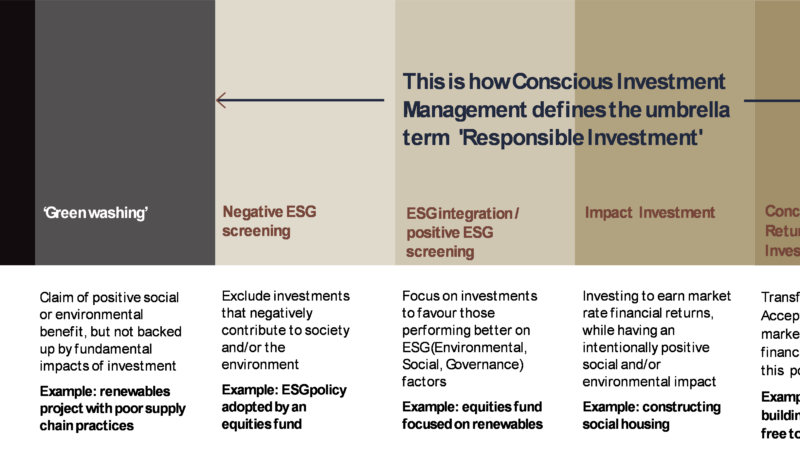

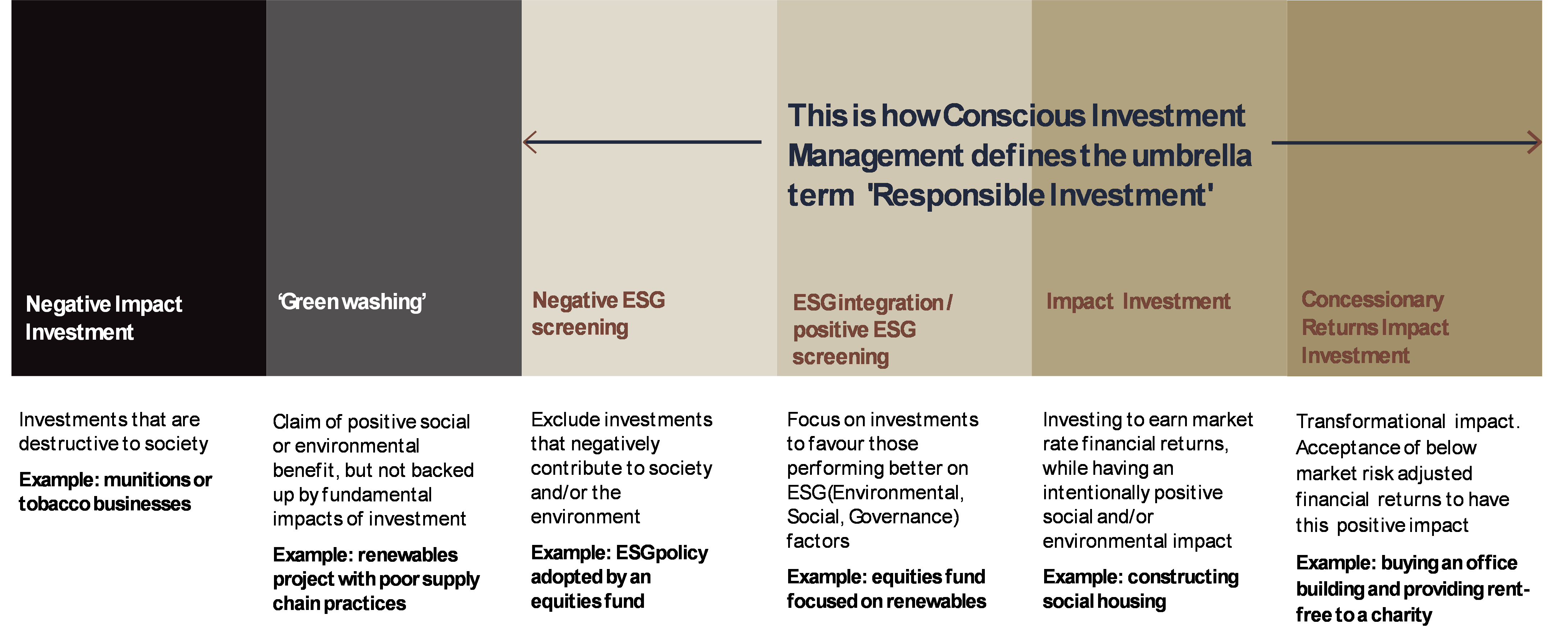

Much of the confusion with the ‘impact investment’ term comes from its similarity to other socially-minded investment strategies. We think about impact investing as a sub-set of a broader term — ‘responsible investing’ — which encompasses a range of different approaches to investing. Two popular responsible investing strategies are ESG ‘negative’ and ‘positive’ screening.

Negative ESG screening, avoids or excludes certain investments that are based on an investor’s ethical values. For example, avoiding companies in coal or tobacco companies.

Positive ESG screening, seeks to invest into companies that score strongly on environmental, social and governance metrics. This approach might see an investor buying the shares of a mining company that scores well compared to its peers in carbon emissions, employee safety metrics, or governance measures.

Impact investment funds differ from ESG investing by targeting specific and additional social and environmental outcomes, such as reducing carbon emissions or to providing more affordable housing.

The Responsible Investment Spectrum

Source: Conscious Investment Management.

What are the challenges of impact investment?

Impact investments are different from negative and positive screens because they aim to create additional, positive social and environmental impacts. This ‘additionality’ requirement can be a challenge for impact investors, and it requires deep thought and consideration about two key challenges of impact investment:

- What are the full effects of an investment? For example, a renewable project (that has good intentions) can be developed with little regard for the supply chain of its solar panels, which may inadvertently support poor labour practices.

- Would this asset have been financed anyway? If an impact investor expects market rate returns, would other ‘non-impact’ investors have funded this anyway?

Investors are asking what is the effect of my investment,

is it making a positive contribution to the world and how is this being measured?

Why does impact investment exist?

Impact investors exist to respond to these two key challenges.

Challenge 1 – A distinct focus on assets that have a positive social and/or environmental benefit

Our sole motivation is to invest in assets that have a positive social and/or environmental benefit. We focus on investigating and testing the full and deep social and environmental consequences of each investment. It’s a core part of our investment process, and as fiduciaries of impact investor capital, applying this level of consideration is key.

As impact investors, our investment universe is often smaller than other market participants (being limited to only socially and environmentally beneficial assets), so we need to focus on understanding the specifics of each opportunity in our ‘hitting zone’. Just like a venture capitalist or property developer in their respective industries, by finding opportunities where others aren’t looking, an impact investor can create additional environmentally and socially beneficial assets while earning attractive returns for investors.

Challenge 2 – Bringing value beyond just capital

Impact investment isn’t like philanthropic capital, it needs to work harder to have a positive social and environmental benefit. Investors seeking market rate returns need to engage with how they can bring value beyond just bringing capital. This may be through finding opportunities that other investors haven’t, doing more work to get comfortable with niche investment sectors, providing longer-term and more stable financing, or a myriad of other ways.

The Conscious Investment Management ‘Impact Partner’ approach is a unique way that we acquire properties, fund assets, or finance social programs which our Impact Partners (the majority are leading charities, but also socially minded enterprises) can operate for the benefit of their mission. In this way, we can make financial investment decisions, with confidence that each house we build, each solar panel we install, will be operated to create the additional positive impact that we intended.

Types of impact assets

Impact investment is an overlay to investment decision making, not an asset class in itself. Having said that, it’s challenging to have an ‘additional’ positive impact on the world when trading secondary securities on an exchange. For that reason, impact investors have tended to focus on (1) primary issuance of securities (for example, green bonds with a use of proceeds focused on specific impactful initiatives), and (2) real assets.

Real assets are a branch of the ‘alternatives’ asset class, which include all value-generating physical assets — land, buildings and social infrastructure (hospitals, schools, specialty housing) — that have intrinsic value in and of themselves, without solely relying on a volatile operating business or exit of an investment create returns.

Real assets investments are naturally attractive for impact investors. Real assets are core to communities. Whether it be through the provision of appropriate and affordable housing, generating renewable energy, or delivering critical services through social infrastructure, our society is built on ‘bricks and mortar’. On tangible foundations.

Despite the societal and environmental importance of these assets, many are suffering from years of underinvestment. There are many examples, such as the very long wait lists for social or disability housing with many people living in legacy housing stocks, or the fact that not everybody has access to cheap and reliable power (let alone renewable energy).

In this context, by building, owning, and appropriately managing real assets, an impact investor can have a targeted and additional positive social and environmental benefit. Each home we acquire and provide to a charity to manage puts another individual into appropriate accommodation. Each solar panel put on a roof decreases the cost of power of the individual sitting below it and reduces carbon emissions. Due to their essential nature and benefit to society, we also believe real assets are more defensive than many other investments.

Seeking better outcomes

Impact investing can help to align an investors’ values with their investments, while still earning strong returns. With many Australians already familiar with ‘real’ or tangible asset classes such as property and infrastructure, as investors, we can create clear positive and additional social and environmental benefits for our communities. Conscious Investment Management’s Impact Partner approach lets us make financial investment decisions in real assets investments, while optimising the on-the-ground asset management to ensure social and environmental impact. Now more than ever, the power of capital markets to have a positive impact is needed.

[1] Responsible Investment Association Australasia study by the Deakin University Business School, June 2020.