Why do we invest where we do?

There are myriad investable asset classes to choose from, and each has certain advantages and disadvantages. In this short article I’ll do my best to outline why we focus our impact investments in real assets.

Real assets are a branch of the ‘alternatives’ asset class, which includes all value-generating physical assets — land, buildings, social infrastructure (hospitals, schools, specialty housing) or commodities — that have intrinsic value in and of themselves, without solely relying on a volatile operating business or exit of an investment to add value.

As investors, with experience in real assets investment, we focus on pursuing the highest level of available returns for our investors with the lowest risk possible.

Uniquely, real assets also offer an exceptional opportunity for impact investors to deliver additional positive social and environmental impact — a concept discussed in our first thought piece, Understanding Impact Investment.

Let’s dive into a few reasons why we love real assets and alternatives investments at The Impact Fund.

Fundamental Impact

We think real assets investments are naturally attractive for many impact investors.

Real assets are core to communities. Whether it be through the provision of appropriate and affordable housing, generating renewable energy, or delivering critical services through social infrastructure, our society is built on ‘bricks and mortar’. On tangible foundations.

Despite the societal and environmental importance of these assets, many are suffering from years of underinvestment. There are many examples, such as the very long wait lists for social or disability housing with many people living in legacy housing stocks, or the fact that not everybody has access to cheap and reliable power (let alone renewable energy).

In this context, by owning, developing and managing real assets, an impact investor can have a targeted and additional positive social and environmental benefit. Each home we acquire and provide to a charity to manage puts another individual into appropriate accommodation. Each solar panel put on a roof decreases the cost of power of the individual sitting below it, and reduces carbon emissions.

Impact Measurement and Management

We seek to maximise our positive social and environmental impact by actively measuring the assets we invest into, and partnering with the best operational management.

From an impact measurement perspective, we seek to conform with impact assessment frameworks (like GIIN’s IRIS+ system, because it’s so widely used), but also need to acknowledge the bespoke nature of many real assets investments.

We think carefully about the metrics we measure, but recognise that numbers on a page can’t tell the whole story. So we also assess outcomes, and report asset-specific case studies (which will be discussed in detail in our next article).

For example, at a portfolio level, The Impact Fund investments made to date have:

- Improved and invested in the operation of 4,616 aged care and seniors housing beds;

- Financed 862 affordable housing properties;

- Employed 9 mentors to assist long-term unemployed young people; and

- Offset the carbon emissions of 202 cars per annum or, thought of another way, planted 15,766 trees.

From an impact management perspective, we focus on management over the life of an asset.

Our due diligence and reporting is influenced by the Impact Management Project, but perhaps most importantly, we spend significant time focusing on selecting an asset manager or operator who aligns best with our goals. Management or operator strategy and capability, along with specific asset characteristics, defines the quality of any real asset (we will also discuss what we look for in an operator in another article).

Scalability and predictability

An important investment question for any asset class is “there might be a gap in the market, but is there a market in the gap?” Equally, we need to be sure that the scale and characteristics of where we choose to invest are suitable for our investors — i.e. is it an appropriate market for investment.

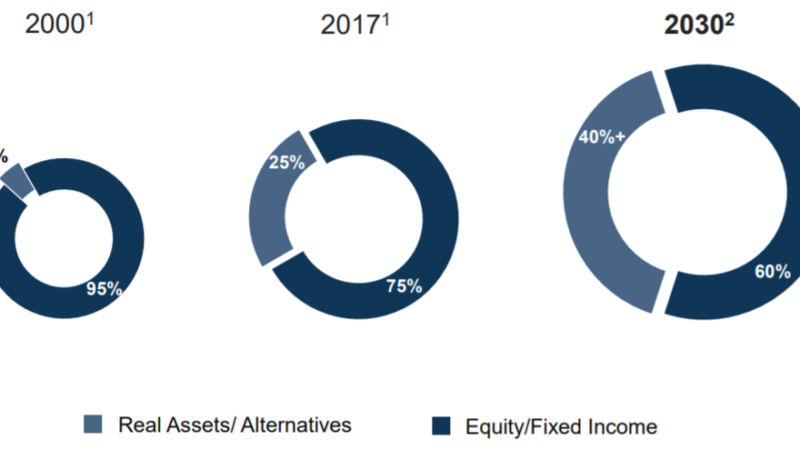

Real assets are a well understood asset class. Most portfolios already incorporate an allocation to real assets, or more broadly, Alternatives, and investors are comfortable with the investment dynamics.

Our view is that, to truly utilise capitalism for good, we must realign large capital flows towards impact investments that have a social or environmental benefit.

Impact investing in real assets has some barriers to entry, however, which we have designed The Impact Fund to overcome:

- Many foundations and fiduciaries have conflicting messages from their various stakeholders about impact investment — our real asset investments can be thought of as property or infrastructure-like, paying long-term stable yields, and providing capital preservation; and

- Real assets often have large cheque sizes and are illiquid in nature. As an impact investment manager, we focus on providing a platform that makes attractive real assets accessible, with a measure of liquidity, to provide real value.

Investment dynamics and correlations

Globally, leading investors are dramatically increasing their allocations to real assets, highlighting the attractive investment dynamics inherent to the asset class.

The investment dynamics that attract us to real assets are their stability, ability to originate strong return profiles with high yields, and consequent low correlation to other asset classes.

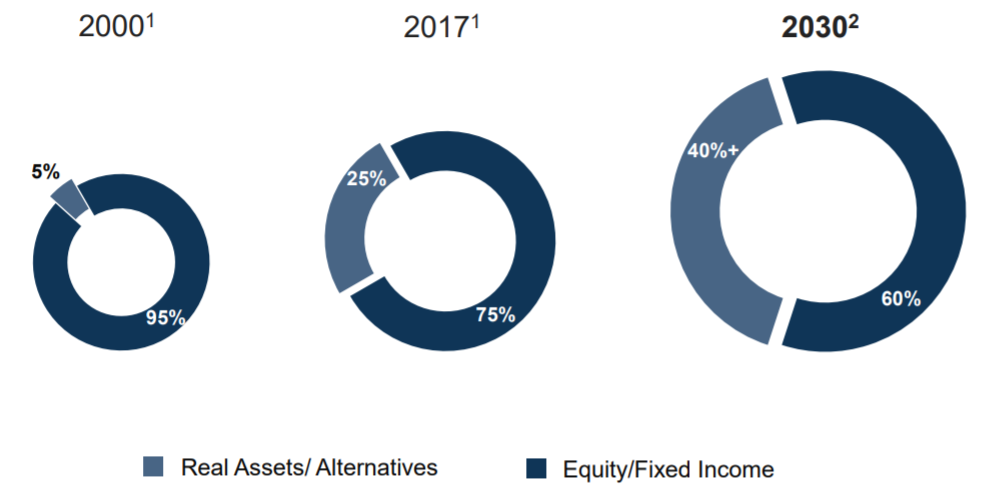

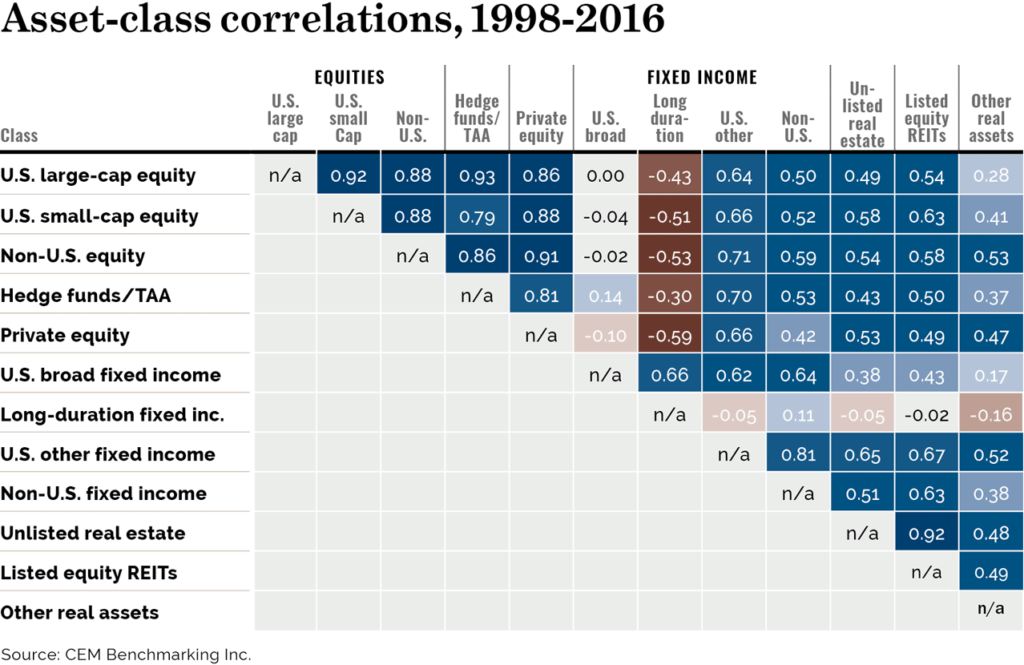

Without going into too much detail (bear with us for a moment!) this low correlation is shown in the diagram below. “Other real assets” (the right hand side) has historically shown low correlation (<0.50) to virtually every other asset class.

The outcome is that real assets can act to defend and protect portfolios. Particularly when they are delivering a fundamental social need (such as affordable housing) which doesn’t go away in a downturn.

Real assets require hard work and a very diligent approach to investment. But they also provide a unique opportunity, through origination and structuring of an investment, to obtain attractive return dynamics with capital preservation.

What we love most about the tangible asset class though is that we can create a positive, additional, social and environmental benefit for our investors and our communities.